We recently fielded an SMB Pulse survey of 500 principals of U.S. companies with up to 500 employees. Among other things, we wanted to understand which resources SMBs use most to research products and services for their business – in other words, which media you should use at the consideration stage of the sales cycle.

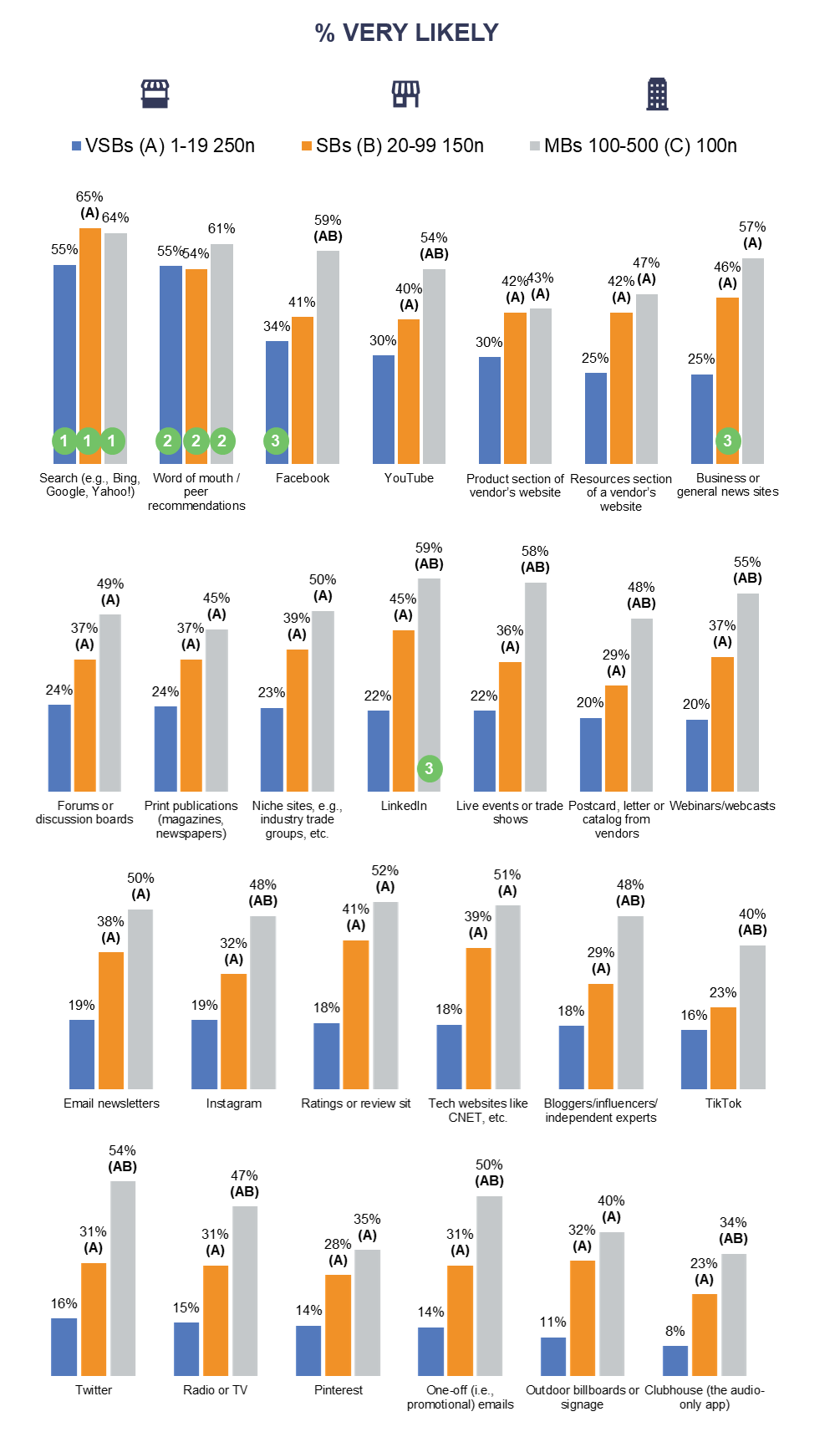

Regardless of company size, SMBs are most likely to use search to assess your offerings. What they search for, of course, can vary – it might be reviews, specifications, competitors, case studies or ratings – but it’s critical that your company and product name rate high in their search results, and that your site is designed to reward SMB visitors with easy access to relevant, comprehensible product information.

SMBs with fewer than 20 employees (very small businesses, or VSBs) are as likely to use word of mouth as search to better understand how your offerings can help them achieve their goals. For SMBs with 20 to 99 employees (small businesses, or SBs) and SMBs with 100 to 500 employees (midsized businesses, or MBs), word of mouth is a close second to search. SMBs rely heavily on peer recommendations; they value the unbiased opinions and experience of other business owners. It’s essential to understand how your customers perceive your offerings, so you know what is being said about them; it is also critical to design your product experience for user success, so your customers proactively drive positive word of mouth.

SMB Research Resource Preferences

How likely are you to use each of these specific information sources to research and/or assess products or services for your business?

You can also take advantage of SMBs’ interest in the experience and opinions of their peers by conducting research and promoting the results. MBs in particular are more likely to use research reports to conduct product research than any other kind of content.

After search and word of mouth, the information source that SMBs are most likely to use varies with company size. VSBs are most likely to use Facebook, whether to get information from their network or to visit your company pages. SBs are most likely to use business and general news sites such as Bloomberg, Business Insider, Entrepreneur, Forbes, the New York Times and the Wall Street Journal. MBs are most likely to use Facebook and LinkedIn, where they can get insight on your offerings from their connections or your company pages.

Research resource usage increases with company size. SBs are significantly more likely than VSBs to use 22 of the 26 information sources we surveyed, and MBs are significantly more likely than SBs to use 12. VSBs are too busy to use a lot of different information sources – only three information sources are used by more than a third of VSBs, as opposed to 16 for SBs and all 26 by MBs. When you connect with busy VSBs, it’s critical to give them concise, comprehensible information explaining how your offerings will help them achieve their business goals. SBs and MBs will explore many more information sources to learn about the benefits of your offerings – but it’s still imperative to make your content comprehensible and relevant, wherever you place it.

Need help understanding and/or engaging SMBs? Bredin can keep you up to date on evolving SMB needs and challenges through quick-turn, actionable market research. We can also help you develop high-value content and social posts to boost SMB awareness, brand perception, leads, conversion and revenue.