One of the things we enjoy most about SMB market research is helping our clients optimize their offerings and pricing. Specifically, we can help them answer questions such as “Which combination of features or functionality will SMBs value most?” and “What’s the best way to price our offering?”

One of the tools we use to understand how SMBs value different attributes of an offering is conjoint analysis. While there are different kinds of conjoint analyses, they all determine the relative importance of specific features to SMBs. The insights can be used to set pricing, prioritize messaging, or rank product development efforts.

What is Conjoint Analysis?

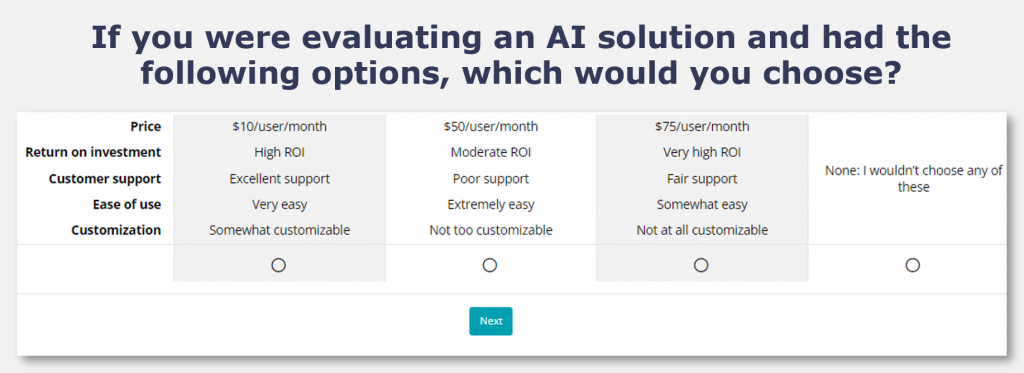

Conjoint analysis (also called trade-off analysis) is a research format that asks respondents – such as SMB principals, IT directors, heads of marketing, etc. – to rank the importance of specific attributes, or to select the combination of attributes about a product or service that they find most compelling. It replaces guesswork with real-world data. As an example, in a survey on the attributes of an AI solution, a conjoint question could look like this:

The respondent is presented with several sets of options, from which they choose one each. The ultimate output is a ranking of each attribute, which can be further assessed, for example, by industry, company size, or other firmographic variables.

Conjoint analysis has many benefits, including estimating the trade-offs that SMBs make in the consideration process, enabling “best customer” profiling, and uncovering drivers that may not even be apparent to SMBs themselves. However, it is complicated to design and assess, and runs the risk of respondent simplification if they are presented with too many choices. It is also weak for new categories, where SMBs may not have a frame of reference.

How Can I Use Conjoint Analysis?

The type of conjoint analysis to use depends on your research goals, and to a lesser degree the type of product or service being assessed including the number of attributes to evaluate). Different kinds of conjoint analysis can even be combined, to get the best of each type. Bredin can recommend the best approach, as well as the number of attributes, presentation format, sample size, and analytic technique. We can also interpret the results for you – including developing a market simulator, to help you model market share for your new or enhanced offering versus competitors.

Want to better understand your SMB target?

Bredin can conduct custom research locally or worldwide to develop in-depth, actionable insights to optimize your go-to-market, product, pricing, UX, and other strategies. We can also turn those insights into high-value content for content marketing, PR, social, or sales support programs.

Related articles